By Duc Nguyen, South East Asia Correspondent

May 6, 2025

IIn Bangkok’s chaotic Sukhumvit district, electric tuk-tuks zip through traffic, driven by entrepreneurs powering MuvMi’s green mobility revolution. These innovators embody Thailand’s startup promise—a potent blend of local ingenuity and global ambition. Real Estate deals are inked via a hugely entrepreneurial spirit to provide the real estate market with clarity and choice. In 2024, the ecosystem celebrated significant milestones: three tech startups reportedly raised $600 million through initial public offerings (IPOs) on the Stock Exchange of Thailand (SET), spanning fintech, logistics, and healthtech sectors (SET, 2024). Early-stage investments are said to have surged by 35%, signaling growing investor confidence (Techsauce, 2024). Yet, beneath this progress lies a critical challenge. A shrinking workforce, rising labor costs, and heavy export reliance threaten to derail growth. As Thailand stands at this juncture, can its startups leverage automation and digital tools to reshape the nation’s economic future?

Structural Pressures on the Economy

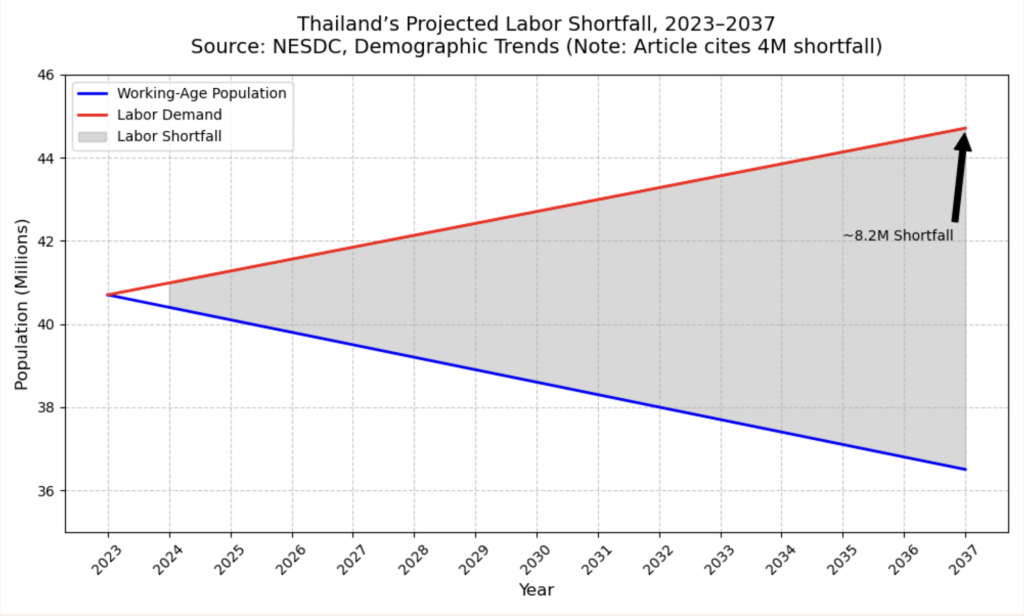

Thailand’s economy, heavily reliant on exports that account for 65% of GDP, faces mounting structural pressures. The National Economic and Social Development Council (NESDC) projects a labor shortfall of 4 million workers by 2037, with the working-age population at 40.7 million in 2023 against a demand of 44.71 million (NESDC, 2024). Minimum wage hikes of 18–28% are straining sectors like manufacturing, agriculture, and construction, which depend on affordable labor. This labor crunch mirrors challenges faced by aging economies like Japan, where robotics has become a cornerstone of workforce solutions, and Germany, which has embraced Industry 4.0 to modernize production.

To remain competitive in ASEAN, Thailand must accelerate its adoption of AI, robotics, and workforce upskilling. Failure to do so risks ceding ground to neighbors like Singapore and Vietnam, which are rapidly advancing their innovation agendas. The stakes are high: without a technological leap, Thailand could struggle to sustain its economic momentum in a region increasingly driven by digital economies.

A Startup Ecosystem Poised for Growth

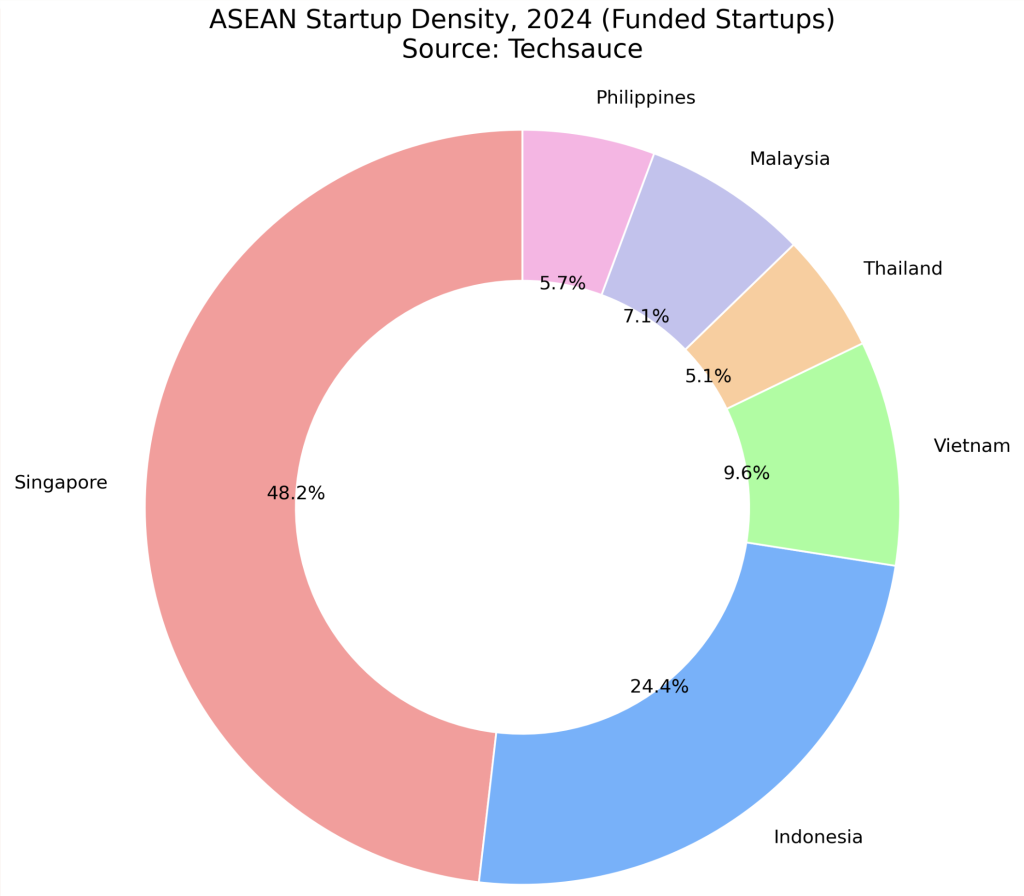

Thailand’s startup scene, while vibrant, remains smaller than its regional peers. In 2024, the country had approximately 180 funded ventures, trailing Singapore (1,700), Indonesia (860), Vietnam (340), Malaysia (250), and the Philippines (200) (Techsauce, 2024). The ecosystem faces hurdles including limited early-stage capital, a lack of mentorship, fragmented support systems, and talent migration to multinational corporations. Additionally, the scarcity of high-profile exits has dented global investor trust, making it harder for Thai startups to attract the funding needed to scale.

Despite these challenges, 2024 marked a turning point. The reported $600 million raised through IPOs reflects a maturing market, with sectors like fintech, logistics, and healthtech leading the charge. Early-stage funding is estimated to have surged by 35%, a sign of growing optimism among investors. This momentum is driven by a focus on B2B platforms, which are increasingly emphasizing trust in areas such as product discovery, quality assurance, and delivery efficiency to meet market demands.

Regulation: Momentum Meets Bureaucracy

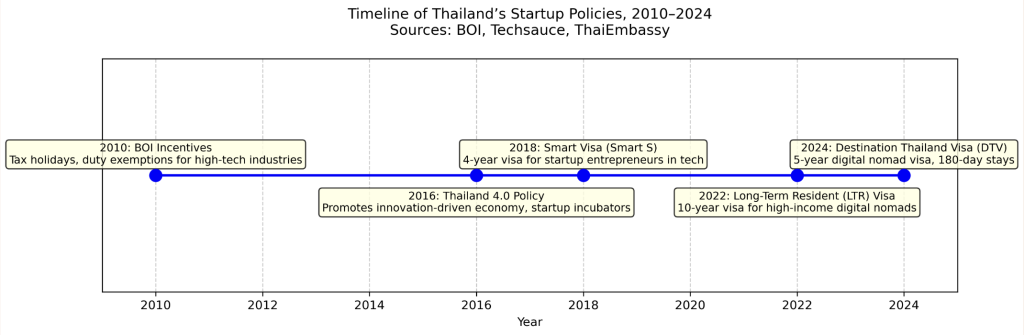

Thailand’s government has laid a foundation for innovation, and this early stage leaves room for execution to be matured and refined. The Digital Economy Promotion Agency (DEPA), established in 2017, distributed $50 million to 200 startups in 2023, providing critical early-stage support. The Thailand 4.0 initiative, bolstered by partnerships with tech giants like Asian communication giants Huawei and Europe’s Ericsson, has positioned Thailand as a 5G leader in ASEAN, enhancing digital infrastructure for startups. The 2024 digital nomad visa reform has also simplified entry for foreign entrepreneurs, attracting global talent to Bangkok’s burgeoning tech scene.

However, bureaucratic delays and outdated policies continue to hinder progress. Complex visa processes and lack of clarity over ever-changing legislation and regulation discourage foreign investment. Unlike Singapore and Malaysia, which have established fintech sandboxes to test innovations, Thailand lacks dedicated spaces for experimentation. This gap slows the pace of innovation, despite a clear governmental vision to foster a digital economy. Streamlining these processes could unlock greater potential, allowing startups to iterate and scale more rapidly.

Thai Startups Redefining Industries

Thailand’s startups are making strides by addressing local challenges with solutions that resonate globally.

FazWaz, a PropertyTech platform, is enhancing transparency in Thailand’s real estate market. In 2024, it reportedly facilitated $1.2 billion in transactions, capturing 15% of Phuket’s residential market. By focusing on digital tools that streamline property dealings, FazWaz is addressing inefficiencies in a sector often plagued by opacity.

Pomelo, a Fashion-Tech company, has thrived with its omnichannel model—allowing customers to order online and try on in-store—generating an estimated $150 million in 2024 revenue. Its logistics innovations, which cut delivery times by 30%, enabled it to navigate the retail slump during COVID-19, positioning it for expansion across ASEAN markets.

aCommerce, an e-commerce enabler serving brands like Unilever and L’Oréal, is said to have driven $200 million in 2024 revenue, with a 40% growth in social commerce. Its end-to-end solutions demonstrate how Thai startups can integrate into global supply chains while addressing local market needs.

MuvMi, a green mobility startup, operates 600 electric tuk-tuks across 12 Bangkok neighborhoods, reportedly reducing CO2 emissions by 1,500 tons annually while serving 200,000 monthly riders. Its environmental impact aligns with Thailand’s ESG objectives, with plans to expand to Chiang Mai by 2026, further addressing urban air quality issues.

Finnomena, a fintech platform, is estimated to have grown its user base to 500,000 in 2024, democratizing investment for Thailand’s middle class through AI-driven tools. Its approach mirrors India’s fintech boom, where technology has expanded financial inclusion.

Freshket, a B2B platform, connects farmers to restaurants and is estimated to have processed $50 million in 2024 orders, cutting food waste by 25%. Ricult, another B2B player, uses AI to support rural farmers, reportedly boosting yields by 20% for 100,000 households, tackling poverty and food security. These platforms aim to integrate fragmented supply chains, making them more accessible to market demand.

Bangkok: A Hub for Innovation

Bangkok has emerged as a focal point for Thailand’s startup ecosystem, fostering innovation through hubs like True Digital Park. This tech center, located in the heart of the city, provides a collaborative space for startups, corporates, and investors, driving the kind of cross-pollination that fuels growth. Such hubs are critical for nurturing talent and ideas, positioning Bangkok as a regional contender in the tech space.

The Exit Gap and Capital Puzzle

The reported $600 million raised through 2024 IPOs marks a milestone, but Thailand lacks a blockbuster exit akin to Indonesia’s GoTo or Singapore’s Grab, limiting its appeal to global investors. Past setbacks, such as Wongnai’s stalled 2022 IPO, highlight risks in valuation and timing. Exploring alternative exits, such as acquisitions by regional giants like Shopee or Lazada, could diversify pathways for startups to scale and exit.

Domestic venture capital remains scarce, forcing startups to rely on volatile regional funds. To deepen capital pools, Thailand could engage pension funds and family offices as limited partners and offer tax incentives for angel investors. Such measures would provide a more stable funding environment, enabling startups to focus on growth rather than survival.

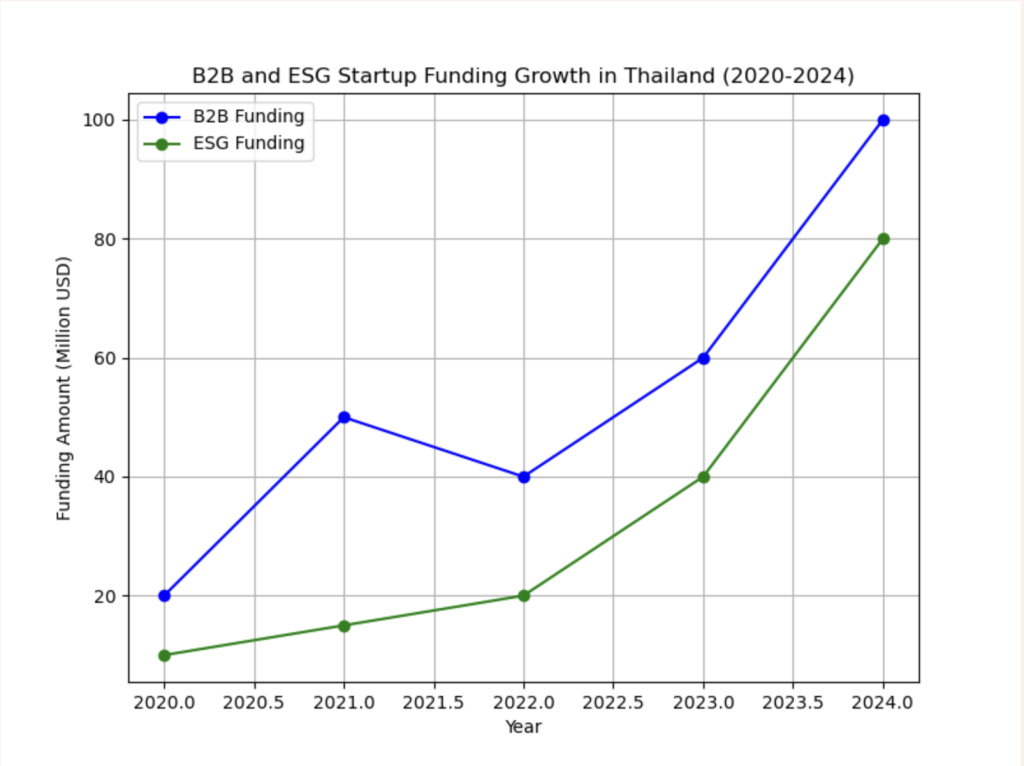

B2B and Sustainability: Thailand’s Edge

Thailand’s startup ecosystem is finding its niche in B2B and sustainability-driven ventures. Platforms like Freshket and Ricult exemplify how technology can modernize traditional sectors, creating efficient supply chains that benefit both producers and consumers. This focus on aggregating fragmented markets to meet demand is a key strategy for scaling in Thailand’s economy.

Sustainability-focused startups like MuvMi are tapping into global ESG investment trends, positioning Thailand as a leader in green innovation. The emphasis on environmental impact resonates with investors increasingly prioritizing sustainable solutions, giving Thai startups a competitive edge in attracting capital.

Two Futures for Thailand’s Digital Economy

Thailand’s digital economy is underpinned by a tech-savvy youth, robust infrastructure, and government ambition. By 2030, two scenarios are possible:

- Breakout: Streamlined regulations, deeper capital pools, and a focus on B2B and sustainability could transform Thailand into an ASEAN innovation hub. Startups like MuvMi and Finnomena might lead the charge, scaling regionally and attracting global attention.

- Stagnation: Bureaucratic inertia and limited funding could leave Thailand trailing Singapore and Vietnam, unable to capitalize on its potential.

Achieving the breakout scenario requires three critical shifts:

- Policy Reform: Simplify visa processes, clarify equity tax rules, and establish innovation sandboxes to foster experimentation.

- Capital Growth: Engage local investors, such as pension funds, and incentivize angel investment to build a more robust funding ecosystem.

- Sector Focus: Prioritize B2B, sustainability, and real-economy solutions that address Thailand’s unique challenges while aligning with global trends.

Global Comparisons and Lessons

Looking beyond ASEAN, Thailand can draw lessons from other emerging markets. India’s fintech boom, driven by companies like Paytm, shows how technology can expand financial inclusion—a model Finnomena is emulating. Brazil’s agtech sector, with startups like AgroSmart, offers a blueprint for Ricult’s efforts to modernize agriculture. These examples underscore the importance of sector-specific innovation, supported by enabling policies and access to capital.

Within ASEAN, Singapore’s success stems from its regulatory agility and deep venture capital pools, while Vietnam’s growth is fueled by a young, tech-savvy population and foreign investment. Thailand must balance these approaches—leveraging its cultural strengths, like adaptability and creativity, while addressing systemic barriers.

The Road Ahead

As ASEAN’s digital decade accelerates, Thailand’s choices will shape its role in the region. The government’s Thailand 4.0 vision, combined with the resilience of startups like MuvMi and FazWaz, offers a foundation for growth. However, realizing this potential requires swift action to address labor shortages, streamline regulations, and deepen capital markets.

The path forward is clear: by fostering an environment where startups can innovate, scale, and compete globally, Thailand can redefine its economic narrative. Whether it leads or lags in ASEAN’s innovation race depends on the decisions made today.