A potential 24% tariff on Malaysian goods by the United States has sent ripples through Kuala Lumpur’s economic and political spheres, raising concerns about trade disruptions, job losses, and strained bilateral relations. Announced as a possible measure to address trade imbalances and protect American industries, the tariff threat comes at a time when Malaysia is already grappling with global economic uncertainties. As policymakers and business leaders scramble to assess the impact, questions linger over how this could reshape Malaysia’s export-driven economy and its diplomatic ties with Washington.

Immediate Economic Fallout

The proposed tariff, which could affect a wide range of Malaysian exports including electronics, palm oil, and manufactured goods, targets a significant portion of the country’s trade with the US, valued at over US$50 billion annually. Malaysia’s electronics sector, a cornerstone of its export economy, could face severe challenges, with industry experts warning of reduced competitiveness in the American market. A leading trade analyst in Kuala Lumpur noted that “the ripple effects could be devastating for small and medium enterprises” dependent on US consumers.

According to data from Malaysia’s Ministry of International Trade and Industry, the US accounts for nearly 10% of the country’s total exports. A 24% tariff could translate into billions in lost revenue, with potential downstream effects on employment. In Penang, often dubbed Malaysia’s “Silicon Valley,” factory workers and tech firms are bracing for uncertainty. One factory manager remarked, “We’ve already faced supply chain issues; this could be the tipping point” as reported by local outlets.

Beyond electronics, the palm oil industry—a key agricultural export—could also suffer. With the US being a significant market for Malaysian palm oil products, a tariff hike might push buyers toward competitors like Indonesia. This could exacerbate existing price pressures in the sector, further straining rural communities reliant on palm oil cultivation. The potential cost to the economy is staggering, with early estimates suggesting a loss of up to 100,000 jobs if the tariff is implemented without mitigation.

Political Ramifications and Diplomatic Challenges

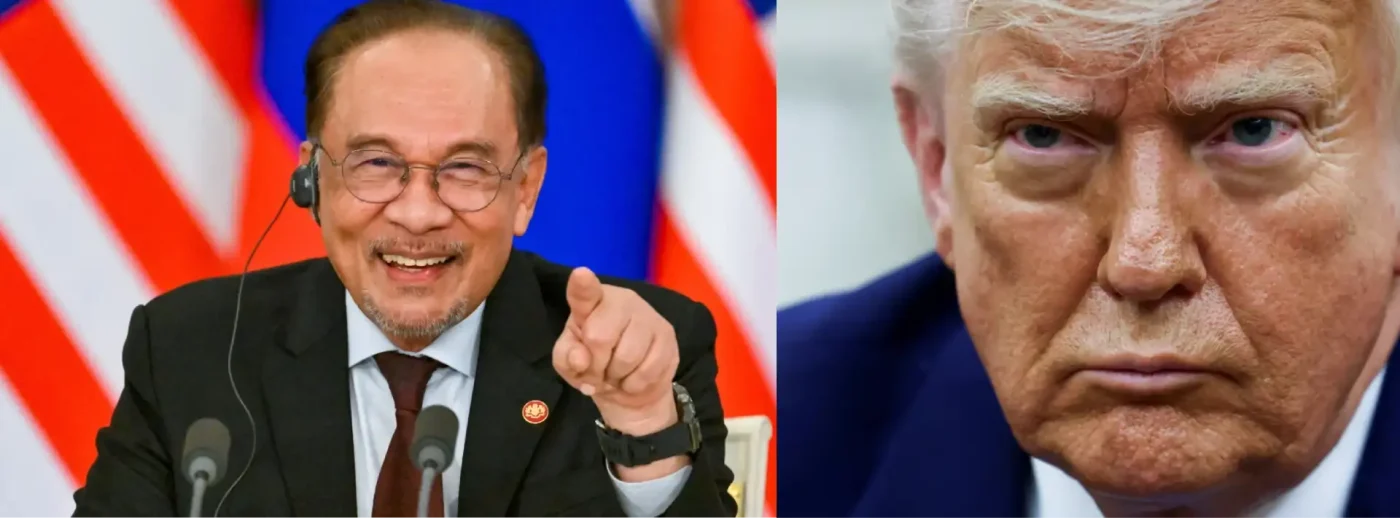

On the political front, the tariff threat has sparked debate within Malaysia’s government over how to respond. Prime Minister Anwar Ibrahim’s administration, already navigating domestic economic reforms, now faces the added challenge of maintaining stable relations with the US while protecting national interests. Government officials have expressed cautious concern, with a spokesperson from the Prime Minister’s Office stating, “We are engaging with our American counterparts to seek clarity and explore solutions” according to state media.

Analysts suggest that the tariff proposal may be tied to broader US policy shifts aimed at rebalancing trade deficits and countering China’s economic influence in Southeast Asia. Malaysia, often seen as a strategic partner in the region, finds itself caught in the crosshairs of this geopolitical chess game. Some political observers in Kuala Lumpur worry that a hardline US stance could push Malaysia closer to Beijing, complicating its traditionally balanced foreign policy.

Public sentiment, as reflected in social media discussions and local editorials, reveals a mix of frustration and pragmatism. Many Malaysians view the tariff as an unfair penalty on a nation that has worked to align with global trade norms. Others, however, urge the government to diversify export markets to reduce reliance on the US, pointing to growing opportunities in the European Union and within ASEAN.

Broader Implications for Southeast Asia

The potential tariff on Malaysia does not exist in isolation—it signals a possible shift in US trade policy toward Southeast Asia as a whole. Neighboring countries like Vietnam and Thailand, which also rely heavily on exports to the US, are watching closely. If implemented, the tariff could set a precedent for similar measures against other regional economies, potentially disrupting the ASEAN trade bloc’s collective bargaining power.

Economists warn that a tariff war in the region could undermine the stability of global supply chains, already battered by post-pandemic recovery challenges and geopolitical tensions. Malaysia, as a key player in electronics manufacturing, plays a critical role in these chains, supplying components for everything from smartphones to medical devices. A disruption here could have far-reaching consequences, impacting consumers and businesses worldwide.

Moreover, the tariff threat raises questions about the future of free trade agreements in the region. Malaysia, a signatory to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), may need to leverage such frameworks to offset potential losses. However, navigating these agreements amidst rising protectionism in the US could prove challenging, with some trade experts cautioning that bilateral negotiations may yield limited results.

Domestic Strategies and Mitigation Efforts

In response to the looming threat, Malaysian authorities are exploring a multi-pronged approach. The Ministry of International Trade and Industry has announced plans to accelerate market diversification, targeting emerging economies in Africa and South Asia. At the same time, incentives for domestic industries to innovate and reduce reliance on US markets are under consideration, though funding constraints may limit the scope of such initiatives.

Business associations, including the Federation of Malaysian Manufacturers, have called for government support in the form of tax relief and export subsidies to cushion the blow. A representative from the federation emphasized, “We need urgent measures to protect our industries” during a recent press conference. While such measures could provide short-term relief, long-term resilience will likely depend on structural reforms and investment in technology to enhance competitiveness.

On the diplomatic front, Malaysia is expected to intensify lobbying efforts in Washington, potentially enlisting the support of US-based multinational corporations with stakes in Malaysian manufacturing. Whether these efforts will sway US policymakers remains uncertain, particularly given the domestic political pressures driving the tariff proposal.

Looking Ahead: Uncertainty and Opportunity

As the specter of a 24% tariff hangs over Malaysia, the nation stands at a crossroads. The immediate economic risks are undeniable, with sectors like electronics and palm oil facing significant headwinds. Yet, this crisis also presents an opportunity for Malaysia to rethink its trade dependencies and build a more resilient economy. Whether through market diversification, innovation, or strategic diplomacy, the path forward will require bold decisions from both government and industry leaders.

For now, businesses and citizens alike await clarity on whether the tariff will materialize and, if so, under what terms. The coming months will test Malaysia’s ability to navigate this challenge while maintaining its position as a key player in global trade. As one Kuala Lumpur-based economist put it, “This is not just about tariffs; it’s about our future in a shifting world order.”