Jakarta – Indonesian manufacturers are sounding the alarm as business confidence plummets to its lowest level in over a decade, driven by fears of looming US import tariffs and weakening global demand. The latest data from S&P Global’s Purchasing Managers’ Index (PMI) report reveals a sharp decline in optimism for the year ahead, with experts warning that this erosion of sentiment could stifle investment, hinder production, and slow job creation in one of Southeast Asia’s largest economies.

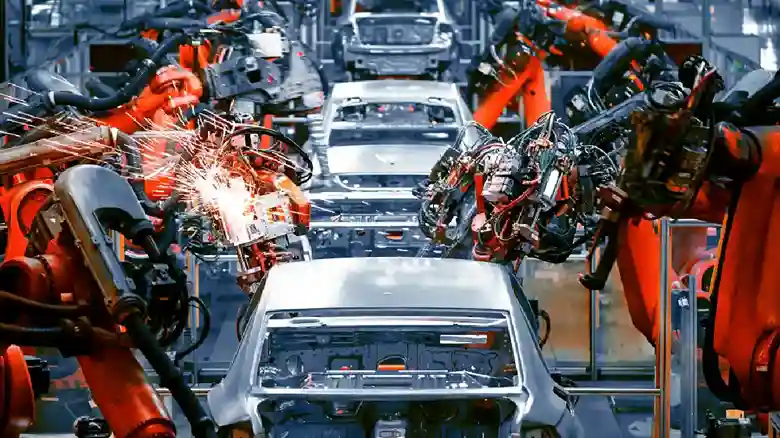

With the manufacturing sector serving as a critical engine of Indonesia’s economic growth, the current downturn signals broader challenges. As geopolitical tensions and trade uncertainties mount, the government faces mounting pressure to stabilize macroeconomic conditions and restore faith in the industry.

A Steep Decline in Optimism

The S&P Global PMI report for July paints a grim picture, showing that manufacturers’ expectations for future business conditions have fallen to their lowest point since the index began in April 2012. Although the headline PMI rose slightly to 49.2 in July from 46.9 in June, it remains below the 50-point threshold that separates expansion from contraction, marking four consecutive months of decline.

Permata Bank chief economist Josua Pardede highlighted the significance of this trend, noting that business confidence is a key predictor of investment and production decisions. “In the short to medium term, weak business confidence could result in slower new investments in the manufacturing sector, which could adversely impact production and job creation” he told a local outlet on August 2, 2025.

Manufacturers are particularly concerned about the potential impact of US tariffs, alongside declining purchasing power among clients, which could further limit production volumes in the coming year. Usamah Bhatti, an economist at S&P Global Market Intelligence, explained on August 2, 2025, that the sector faced another negative month with sustained downturns in output and new orders, though the pace of decline eased slightly from June.

Bhatti also pointed to a renewed drop in export orders and ongoing reductions in employment and purchasing activity, signaling that firms remain in a cautious, retrenchment mode. Companies reduced material purchases in July, citing lower production needs and a focus on depleting existing stock, extending a four-month decline in purchasing activity.

External Pressures and Supply Chain Strains

Adding to the sector’s woes are external pressures, including supply chain disruptions and rising costs. The S&P Global survey, conducted between July 10 and 24, noted longer delivery times due to shipping delays and disruptions linked to a 12-day Iran-Israel conflict in mid-June. These delays have compounded challenges for manufacturers already grappling with a volatile global trade environment.

Cost inflation also reached a four-month high in July, driven by rising raw material prices and exchange rate fluctuations that have increased the cost of imported goods. This price pressure is squeezing profitability, further dampening manufacturers’ willingness to scale up production or hire additional workers. Josua emphasized that without strategic interventions to manage inflation and boost domestic spending power, the sector’s recovery could remain elusive.

“Without strategic measures and appropriate policy interventions, the weak business sentiment risks prolonging the manufacturing sector’s contraction, hampering broader economic recovery” he warned on August 2, 2025.

Trade Tensions with the US

A significant factor weighing on sentiment is the uncertainty surrounding US trade policies. While the S&P Global survey responses were largely collected before a recent bilateral trade agreement with the US was announced on July 22, 2025, the threat of tariffs has loomed large over Indonesian manufacturers. According to a joint statement published on the White House website, Indonesia has agreed to eliminate tariffs on 99 percent of US goods, including agricultural products, seafood, pharmaceuticals, automotive items, and information and communication technology equipment.

In return, Washington will lower its reciprocal tariff on Indonesian goods from a previously threatened 32 percent to 19 percent, with potential further reductions for select commodities not naturally available or produced domestically in the US. While this agreement offers some relief, the earlier tariff threats have already eroded confidence, and manufacturers remain wary of future trade frictions.

A research note from PT Samuel Sekuritas Indonesia, published on August 2, 2025, underscored that reviving optimism among manufacturers will depend on effectively managing external trade pressures and stabilizing global commodity prices. The note also stressed the importance of domestic fiscal and monetary policy support, warning that record-low sentiment amid US tariff concerns could undermine Indonesia’s external competitiveness and exacerbate its vulnerable trade position.

Signs of Resilience Amid Challenges

Despite the prevailing gloom, there are flickers of resilience in Indonesia’s manufacturing sector. The Industry Ministry reported on August 1, 2025, that the country’s business confidence index (IKI) rose to 52.89 in July, up 1.05 points from 51.84 in June. This uptick, attributed to increases in new orders, inventories, and production, suggests that the sector remains in an expansion phase despite global uncertainties.

Ministerial spokesperson Febri Hendri Antoni Arif noted that the rise in IKI reflects the sector’s ability to weather challenges, including weakening economies among key trade partners like the US, Japan, China, and several European countries. However, he acknowledged that a contraction in output indicates manufacturers are still hesitant to ramp up production amid lingering uncertainties.

Bank Danamon economist Hosianna Evalita Situmorang described the IKI improvement as a sign of gradual recovery, driven by growing domestic demand. However, she cautioned that persistent challenges, including slow government spending in the first half of 2025, have limited the impact of interest rate cuts on the real sector. “Looking ahead, hopefully [business confidence] will improve, given the accelerating government spending and improved liquidity” she said on August 2, 2025.

The Road Ahead for Indonesia’s Manufacturing Sector

The contrasting signals from the PMI and IKI highlight the complex landscape facing Indonesia’s manufacturing industry. On one hand, the record-low confidence reported by S&P Global underscores deep-seated concerns about external trade pressures and internal economic conditions. On the other, the slight uptick in the IKI suggests that domestic demand and targeted policy measures could provide a foundation for recovery.

Analysts agree that the government’s role will be pivotal in navigating these challenges. Stabilizing macroeconomic conditions through inflation control, boosting consumer spending power, and mitigating risks from international trade disruptions are seen as critical steps. Additionally, addressing supply chain bottlenecks and supporting manufacturers through fiscal incentives could help restore confidence and encourage investment.

The broader implications of the manufacturing downturn extend beyond factory floors. As a key driver of employment and economic growth, the sector’s struggles could ripple through Indonesia’s economy, affecting everything from household incomes to government revenues. With geopolitical tensions and global economic uncertainties showing no signs of abating, effective navigation of these headwinds will be essential for restoring stronger growth in the quarters ahead.

As Indonesia grapples with these challenges, the resilience of its manufacturing sector will be tested. Whether strategic policy interventions can turn the tide remains an open question, but the stakes for the nation’s economic recovery could not be higher.