In a dramatic turn of events, Nescafé, the iconic instant coffee brand synonymous with Thailand’s morning ritual for over five decades, finds itself at the center of a bitter legal dispute. A recent court injunction has halted the production, distribution, and sale of Nescafé products across the country, threatening the brand’s long-standing dominance in one of Southeast Asia’s most lucrative coffee markets. The conflict pits global food giant Nestlé against the powerful Mahagitsiri family, its former business partners in Thailand, raising questions about the future of a partnership that once thrived on mutual success.

A Partnership Unraveled

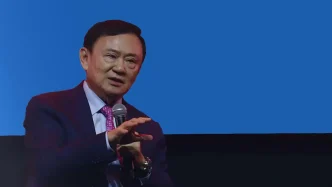

For more than 30 years, Nestlé collaborated with the Mahagitsiri family through Quality Coffee Products (QCP), a joint venture established in 1990 to manufacture Nescafé in Thailand. Both parties held a 50% stake in QCP, creating a robust alliance that propelled Nescafé to the top of the Thai coffee market. Prayudh Mahagitsiri, a prominent businessman often dubbed the “Godfather of Nescafé” in Thailand, became a key figure in the brand’s local success. The partnership flourished, fueled by Thailand’s growing appetite for instant coffee and the iconic red mug that became a household symbol.

However, this alliance began to fracture in 2021 when Nestlé terminated its production agreement with QCP. The decision was later upheld by the International Court of Arbitration, with the termination taking effect at the end of 2024. While the legal basis for the split appeared settled, tensions escalated when Chalermchai Mahagitsiri, a major shareholder in QCP with a 41.80% stake compared to Nestlé’s 30.00%, launched a separate legal challenge against Nestlé’s Thai operations and its directors. On April 3, 2025, the Minburi Civil Court in Bangkok delivered a significant blow to Nestlé by granting a temporary injunction that prohibits the company from producing, contracting, distributing, or importing Nescafé products in Thailand.

This injunction, while temporary, has immediate and far-reaching implications for Nestlé, the sole owner of the Nescafé trademark globally. It effectively freezes the brand’s operations in a market where it has enjoyed unparalleled success for over half a century.

The Stakes in Thailand’s Coffee Market

The Thai coffee market, valued at approximately 60 billion Thai Baht (US$1.68 billion as of April 11, 2025), is a fiercely competitive arena. The in-home segment, dominated by instant and 3-in-1 coffee products like Nescafé, accounts for roughly 33 billion Baht (US$924 million), while the out-of-home market, including cafes and ready-to-drink options, contributes another 27 billion Baht (US$756 million), according to data from Euromonitor. Within this landscape, the ready-to-drink coffee segment alone is worth 24 billion Baht (US$672 million), as reported by Tetra Pak Compass in 2023.

Nescafé, through QCP, has been a major player in this market. Financial records show QCP’s revenue reached over 17.1 billion Baht (US$479 million) in 2022, with a net profit of 3.067 billion Baht (US$86 million), despite a slight decline of 9.84% from the previous year. In 2021, the company saw revenue growth of 10.69% to 17.1 billion Baht (US$479 million), though net profit dipped by 8.14% to 3.4 billion Baht (US$95 million). Even in 2020, amidst global economic challenges, QCP reported revenue of 15.4 billion Baht (US$431 million) and a net profit of 3.7 billion Baht (US$104 million). These figures underscore the financial weight of the dispute and the potential losses at stake for Nestlé if the injunction persists.

Thailand’s coffee consumption habits further highlight Nescafé’s cultural footprint. The average Thai consumer drinks around 340 cups of coffee per year, according to Nestlé’s own data, with instant coffee remaining a staple in homes and offices. The fresh coffee market, though smaller, is valued at over 5 billion Baht (US$140 million), signaling room for growth in premium segments. For Nestlé, losing ground in Thailand could mean not just financial losses but also a dent in its regional brand equity.

From Brazilian Surplus to Thai Staple: Nescafé’s Legacy

Nescafé’s journey to becoming a global icon began in 1929 when Nestlé’s then-chairman, Louis Dapples, responded to Brazil’s plea to address a surplus of coffee beans. Tasked with creating an easy-to-prepare coffee product, Nestlé spent seven years refining its formula before launching Nescafé instant coffee powder in Switzerland in 1938. The product sold out within two months, marking the start of a worldwide phenomenon. Today, Nestlé operates over 2,000 brands in more than 180 countries, with Nescafé standing as one of its most enduring successes.

In Thailand, Nescafé arrived 52 years ago, quickly embedding itself into the nation’s daily life. Through sustained marketing efforts, including the iconic “Red Cup” imagery, the brand captured the imagination of Thai consumers, becoming the undisputed leader in the instant coffee segment. Nestlé’s 130-year history in Thailand—part of its 150-year global legacy—further solidified its position as a trusted name. Yet, the current legal battle threatens to unravel decades of goodwill and market dominance.

Legal and Business Implications

The Minburi Civil Court’s injunction represents a rare and significant challenge to a multinational corporation like Nestlé in Thailand. While the ruling is temporary, it raises questions about the long-term viability of Nestlé’s operations in the country if the Mahagitsiri family’s legal actions succeed in a more permanent capacity. The dispute also highlights the complexities of joint ventures in emerging markets, where local partnerships are often critical to navigating cultural and regulatory landscapes but can sour over strategic disagreements.

Legal experts suggest that Nestlé may appeal the injunction or seek alternative resolutions, potentially through out-of-court settlements or renegotiated terms with QCP. However, the public nature of the feud, coupled with the Mahagitsiri family’s influence in Thai business circles, complicates the path forward. For now, Nestlé’s ability to produce or sell Nescafé in Thailand remains stalled, leaving shelves potentially empty of a product that has been a staple for generations.

From a business perspective, the dispute could open opportunities for competitors in the Thai coffee market. Local and international brands may seize the moment to capture market share, particularly in the instant coffee segment where Nescafé has long reigned supreme. If the injunction persists, consumers might turn to alternatives, reshaping brand loyalties in a market known for its fierce competition.

Consumer Sentiment and Cultural Impact

Beyond the courtroom and boardroom, the Nescafé dispute resonates deeply with Thai consumers. Social media platforms, including posts on X, reflect a mix of surprise and concern among users, many of whom associate Nescafé with personal memories of family breakfasts or late-night study sessions. The brand’s red mug is more than a marketing symbol; it is a cultural touchstone in a country where coffee consumption bridges traditional and modern lifestyles.

The potential absence of Nescafé from Thai stores could disrupt daily routines for millions. While it is too early to gauge the full extent of public reaction, the dispute underscores the emotional connection consumers have with familiar brands. For older generations, Nescafé represents continuity and comfort; for younger Thais, it is a convenient and affordable choice amidst a growing array of coffee options.

Looking Ahead: A Brewing Uncertainty

As the legal battle between Nestlé and the Mahagitsiri family unfolds, the future of Nescafé in Thailand hangs in the balance. Will the injunction be lifted, allowing the brand to reclaim its market position, or will this mark the beginning of a prolonged exit from one of Southeast Asia’s most dynamic economies? The outcome could set a precedent for how multinational corporations navigate partnerships and disputes in the region.

For now, Thai coffee drinkers watch from the sidelines, their morning brew caught in a storm of legal and corporate maneuvering. Whether Nescafé can weather this challenge remains an open question, but its absence—even temporary—leaves a void in a market it once defined.